What is a Company Registration Number and Where Can I Find it?

When you form either a limited company or limited liability partnership (LLP) you will be assigned a company registration number or CRN. This is provided by Companies House when you initially register and remains the same for as long as your company is in operation, even if you elect to change the name.

The CRN consists of either a unique sequence of 8 numbers or two letters followed by six numbers. The number is created sequentially by Companies House and depends on where you are incorporating your business:

- If you have registered a limited company in England or Wales, your company registration number will begin with a number

- The CRN for companies in Scotland is slightly different as it begins with SC

- If you are registering a limited liability partnership, your number will start with OC in England and Wales, and SO in Scotland

- There are also several other prefixes for different types of entity and for other jurisdictions

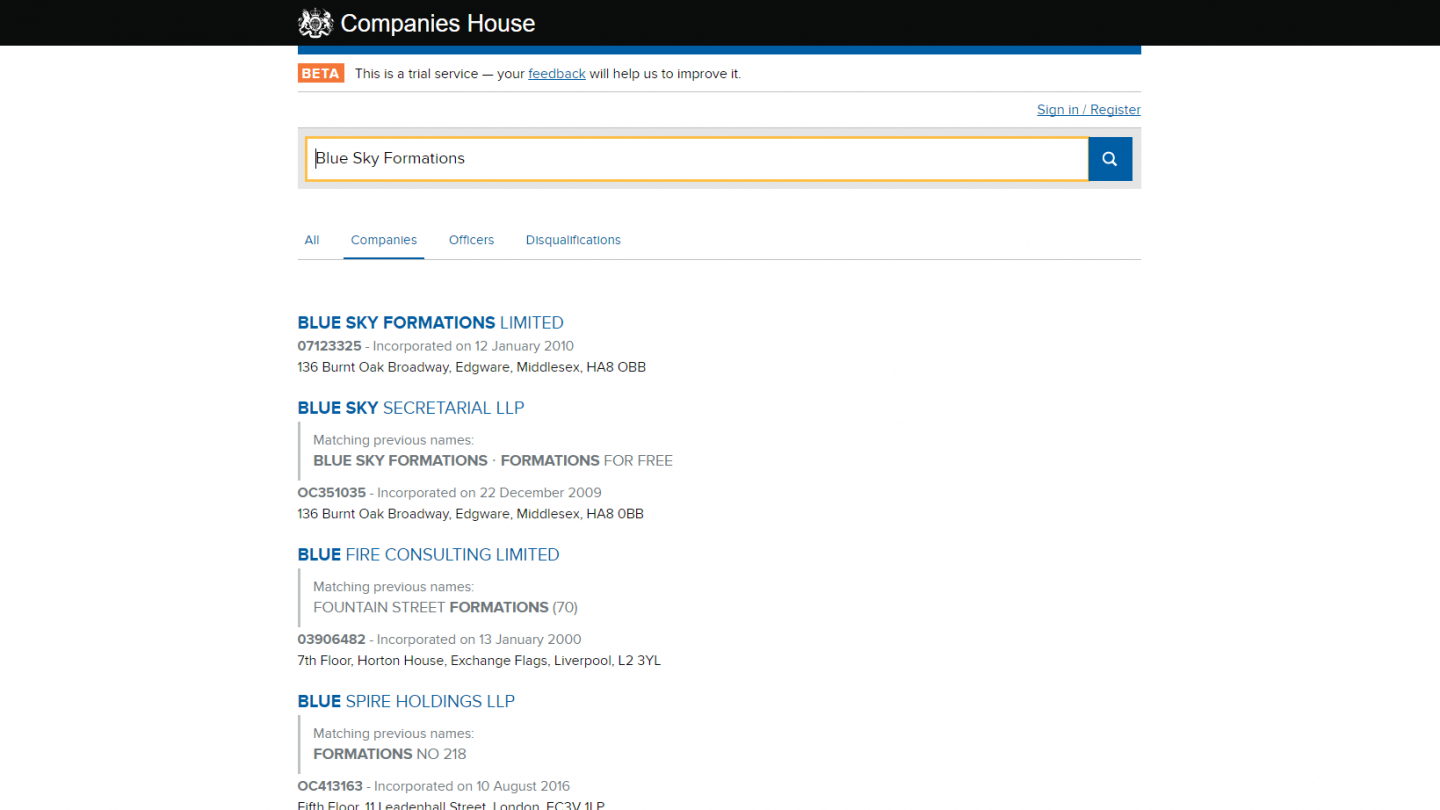

Your CRN is included on your incorporation certificate when you get the paperwork from Companies House after successful registration. If you don’t have it to hand you can go onto the Companies House website and search for it by entering your company name.

What Do I Use the CRN For?

There are numerous times when you will need to have your company registration number handy, for instance, any time you want to make changes to the information you hold at Companies House. This can include when you want to change the name of your company, if you have new directors or members leaving, or want to alter your company office or SAIL address. Other times you will need it are:

- When you register for business taxes with HMRC, fill in tax returns or need to pay corporation tax

- Applying for a business bank account

- When you file your annual confirmation statement and accounts

- When you change your Accounting Refence Date (ARD)

- Any transactions associated with your company such as filling resolutions or issuing share certificates

Once you become a limited company or LLP you will need to ensure that all your official letters, compliment slips, ordering stationary, invoices and receipts and even your website have the number clearly shown.

FAQs on Company Registration Numbers

What is the Point of a CRN?

It identifies your company and legally verifies its existence as an incorporated entity.

Is the CRN the same as the VAT number?

No. They are two separate numbers. VAT numbers are issued only by HMRC when you register for VAT with them. Neither is your CRN your company tax number. Again this is a unique number produced by HMRC called your UTR.

Do You Need a CRN as a Sole Trader?

No. You only get a CRN if you are a limited company or limited liability partnership. You will register with HMRC separately as a sole trader and carry out a self-assessment to pay your taxes.

I Can’t Find My CRN?

There are several places where you’ll find your CRN. The first is on the Certificate of Incorporation that you received from Companies House when you registered. Look for a heading saying ‘company number’. You will from time to time receive correspondence from Companies House and your CRN will always be found on this. If you are out of the office or can’t find the CRN, then you can always visit the Companies House website and search for your business. This will give you your CRN in just a few seconds.

Can I Check if a Company has a CRN?

If a company is registered in the UK, then it will have a CRN on its literature. If you want to check if this is valid, then all you need to do is a search. The Companies House website has some 170 million records which are free to access. Simply enter the CRN or the company name to find out if it is valid or not.

What Are the Benefits of Having a CRN?

This is more a question about the benefits of setting up as a limited company. The company has its own legal identity so the contract of any third party is with this rather than individual directors and shareholders who have limited liability. Setting up a limited company can also improve your standing and prestige in comparison to a sole trading position which means you may be more likely to get certain clients and attract potential financing for expansion. There are also some tax benefits that sole traders don’t get.

A company registration number or CRN is only available for limited companies or limited liability partnerships. The 8 letter/digit combination is unique to that business and is retained for the time that it is in operation and only becomes redundant when the business is dissolved. You need it for numerous things including filing returns and when you come to put in your tax assessment for the year.