How to Change Your Company Name

Changing your company name is relatively simple in the UK but there are some strict guidelines. This guide will give you 3 easy ways to change it.

There are numerous reasons why you might want to change the name of your company. It’s not an uncommon thing to happen, even large corporations such as Google (Backrub) and Pepsi Cola (Brad’s Drink) used to be called something different.

5 Common Reasons to Change a Company Name

- Your current name may not say everything you want to about your business.

- You might want something easier to remember for your customers now that your company is starting to grow.

- Your company name may be too long or too short.

- It could be too closely related to a competitor.

- You might even be trying to combat bad press associated with your existing name and looking to rebrand or head in a different direction.

Considerations before you change your company name

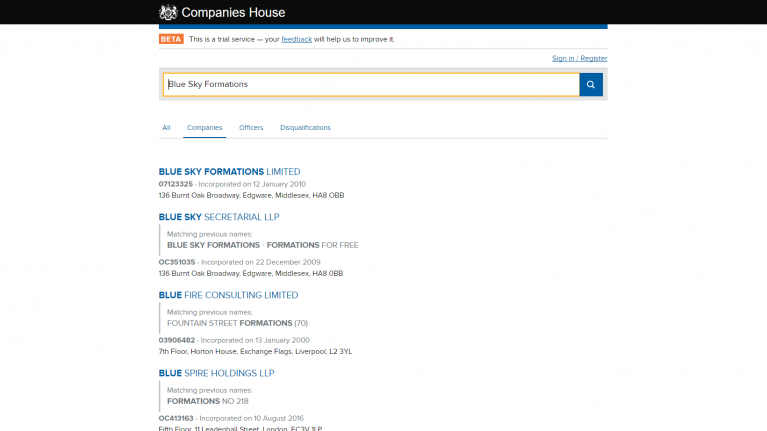

Changing your company name is relatively simple in the UK but there are some strict guidelines. The name you choose needs to comply with the normal naming rules for creating a limited company:

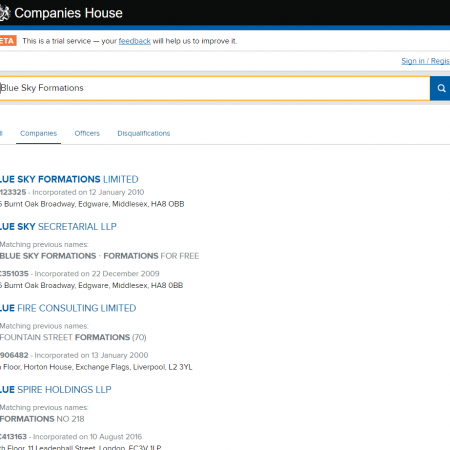

- You can’t choose a name that is the same as an existing company on the register.

- It can’t be too like another company name so that it causes confusion.

- It can’t be offensive.

- It can’t hint at a connection between government or local authority institutions unless that has been agreed.

Generally, you need to use ‘Limited’ in your name. The exceptions are if you are a registered charity, are a company limited by guarantee with agreement in the articles of association, or have a business name where you trade via an alternative to your registered name.

The 3 Easy Ways to Change a Company Name

- You can pass a special resolution which needs to be agreed by the members of the company. These will either be guarantors or shareholders. Three quarters of the members have to agree to the change and it can either be voted on at a general meeting or through a written resolution. The split of the vote should consider the number of shares held by particular shareholders rather than just a count of interested parties.Once a vote is held, the directors are then required to send notification of the decision. A Form NMO1 needs to be completed within 15 days and submitted to Companies House.

- Under certain circumstances, the directors of the company can decide to change the name of the company if they have this power set out in the articles of association. In this case, they don’t have to consult the shareholders. Again, once the decision has been made, a Form NMO1 has to be submitted to Companies House.

- Our Company Secretarial team can take care of the entire procedure for you. Check out our post-incorporation services or contact our team today.

How Much Does It Cost to Change a Company Name?

The cost to change a company name is £10 or £50 if you are looking for a same day service. You swill need to submit the form along with a copy of the resolution for the change of name if this is needed.

What Happens Next?

You cannot start using the new name for your company until you have had confirmation back from Companies House. This comes in the form of a Certificate of Incorporation on Change of Name and will tell you the date when you can implement the change.

You need to keep a copy of this at your head office or SAIL address in case it needs to be inspected by relevant parties. All other aspects of your company will remain the same so you will also need to hang onto your original certificate of incorporation.

The next step is to ensure that your details match across all your current operational material and connections. Primary among these is making sure that any business accounts with your bank and financial arrangements are changed to comply with what is now on record at Companies House. For your bank, this generally involves filling in the relevant form and including a copy of the Certificate of Incorporation on Change of Name. Some may well allow you to do this online with a digital copy.

Once you have had approval from Companies House, the next step is to change all your signage, digital and hardcopy material. From the time that you have received notification of the name change from Companies House you have 14 days to do this. There’s often more work to do in this area than most people think, for instance:

- You need to contact HMRC with updates to your bank account and name change details.

- There will be numerous clients, suppliers and other interested parties that you will need to contact.

- Any online presence including your domain name, visual material, stationary or audio advertising will have to be updated to reflect your new name.

- You don’t have to change anything in the memorandum and articles of association.

While the process can happen quickly, it makes sense to have all the procedures in place once the change goes through so that you can update your relevant parties and promotional .